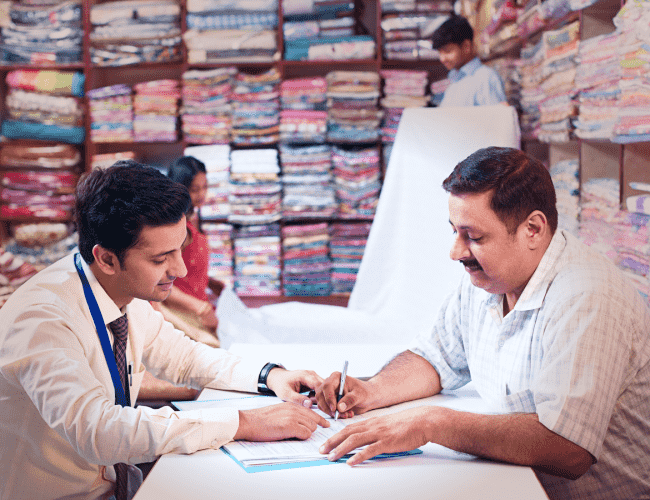

Maximize Your ROI: Optimize Your Retail Investment with Loan Solutions

Retailer loans are special money tools made for businesses in the retail industry. These loans are designed to help retailers with different money needs, like managing inventory, expanding their stores, or upgrading their technology. Retailer loans can vary in how much money you can get, the interest rates, and when you have to pay it back. One big benefit of retailer loans is that they give retailers the money they need to take advantage of opportunities or deal with challenges that are specific to their industry. Whether it's handling changes in customer demand throughout the year, investing in online shopping capabilities, or renovating their physical stores, these loans help retailers make smart choices for growing their business. Lenders who offer retailer loans look at things like how healthy the retailer's finances are, how trustworthy they are with money, and what they need the loan for. This makes sure businesses get the right kind of loan for their specific situation. Some loans also offer flexible ways for retailers to pay back the money, so they can manage their finances well. To sum it up, retailer loans are really important for helping retail businesses keep going and growing. By providing money support that's specifically targeted for retailers, these loans help them deal with changes in what customers want and trends in the industry. Retailers need to think carefully about how much money they need, check out the different loan options available, and pick the one that fits best with their business plan for long-term success.